Hot running in a wall of resistance to long frames.

Bear will look for an improvement to improve past performance.

Update: Gold (XAU / USD) is at the highest level and the price is below $ 1870 with a strike in the oversupply of the curve, helping to prevent the US from falling. dollar. Gold prices have rebounded from their highs of $ 1874 to $ 1874 over the past three months as the bearish recovery continues in the hope that the Fed will; keep interest rates low for the long term, again, especially after weak reports of American sellers tamed about the rise. inflation.

Gold also received further support after Dallas President Robert Fed reiterated Monday that he did not expect it to rise further next year. Meanwhile, growing numbers in Asia and growing seas in the Middle East keep animals living in beneficial environments.

Read: Gold Weather: XAU / USD bulls sell for $ 1,850 after controlling again

At the time of writing, gold is trading slightly higher in Asia at 0.13% in XAU / USD.

XAU / USD was up 1.26% on Monday to $ 1,868.50, adding a little extra to hit a new high of $ 1,869.71, marking a cautious start to the week for global commodity prices.

Global equities have been around a fast night with yields on the contract rising further on the Goldilocks scenario for gold as the US financial story falls behind after the CPI win last week.

Meanwhile, Federal Reserve Chairman Richard Clarida said the Fed would respond to higher inflation if needed, but he and others, including Fed Chairman Jerome Powell, were constantly told him not to die now. Time is to start talking tap while they work. deep in nature.

We saw the minutes on Wednesday at the Government Security Committee meeting policy last month.

Investors will have to look to more muscle on the bone in the expectations of financial experts over the market and the importance of their assumptions about inflation. cost and market return.

Financial managers are patient

Meanwhile, TD Securities analysts have explained that money managers are finally raising their debt as the non-agricultural high catalyzes around algorithmic short-term trading, helping northern burst rates of $ 1800 / oz range.

'' At the same time, we note that the mix of gold yields, indicates that the potential demand can be put in higher gold, but rising ETF flows with the placement of funds. Care has since given strength to this view - especially since the “transient” financial debate rises to the ground.

Choose your poison, but more plausible scenario's to finally see the gold price tag. '

Gold analysis

Prior analysis, daily chart

According to previous assessments, the Weekly Record: Gold on the way to $ 1,855, the gold price added to Friday its protection close.

Meanwhile, -272% Fibo removal from the previous correction of $ 1,855 was easier.

Live market, daily chart

In fact, we see a perfect start to -61.8% Fibo at the high of the sun.

A correction is the probability that the venue will open this Fibonacci level of 38.2% and the previous youth $ 1,845.

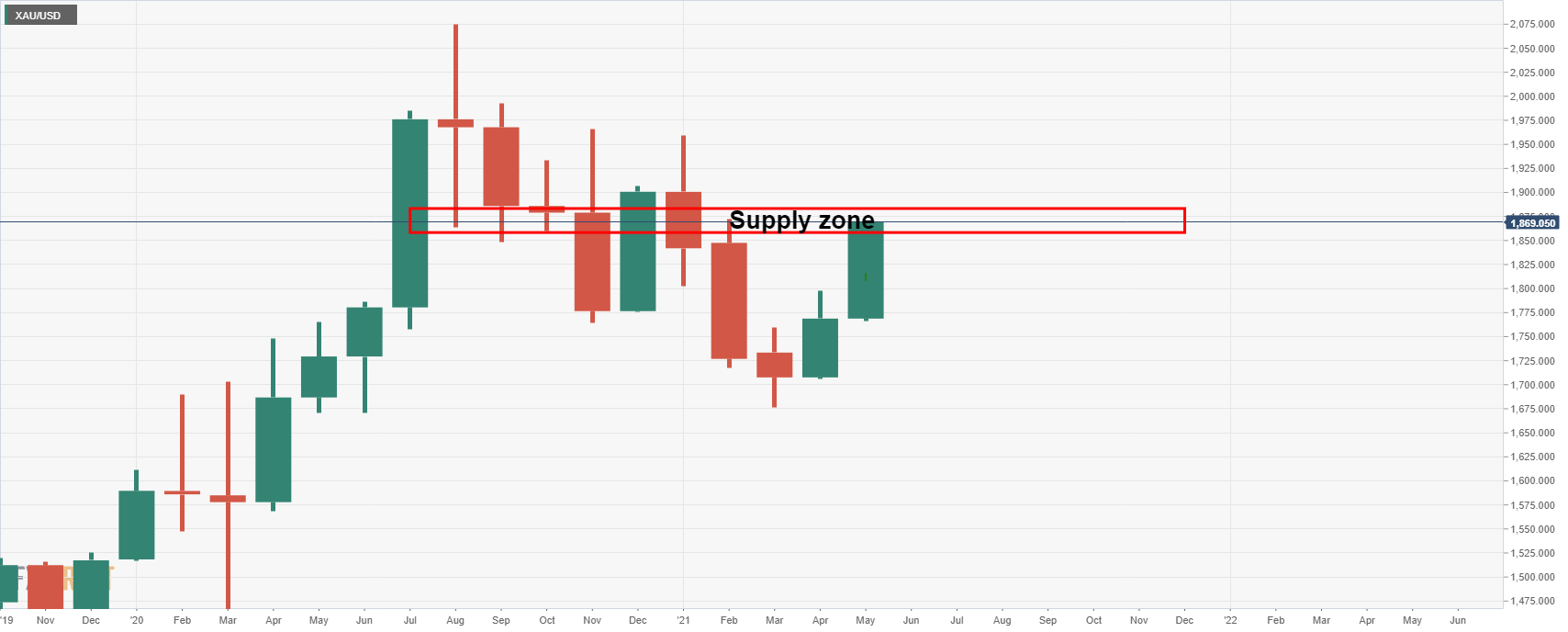

If we take a long-term view of the frames, it also determines the business model in the monthly diagram as follows:

Although escalation is still an additional potential, the monthly supply chain will make it difficult for the calves to burst immediately.

Further reading:

0 Comments