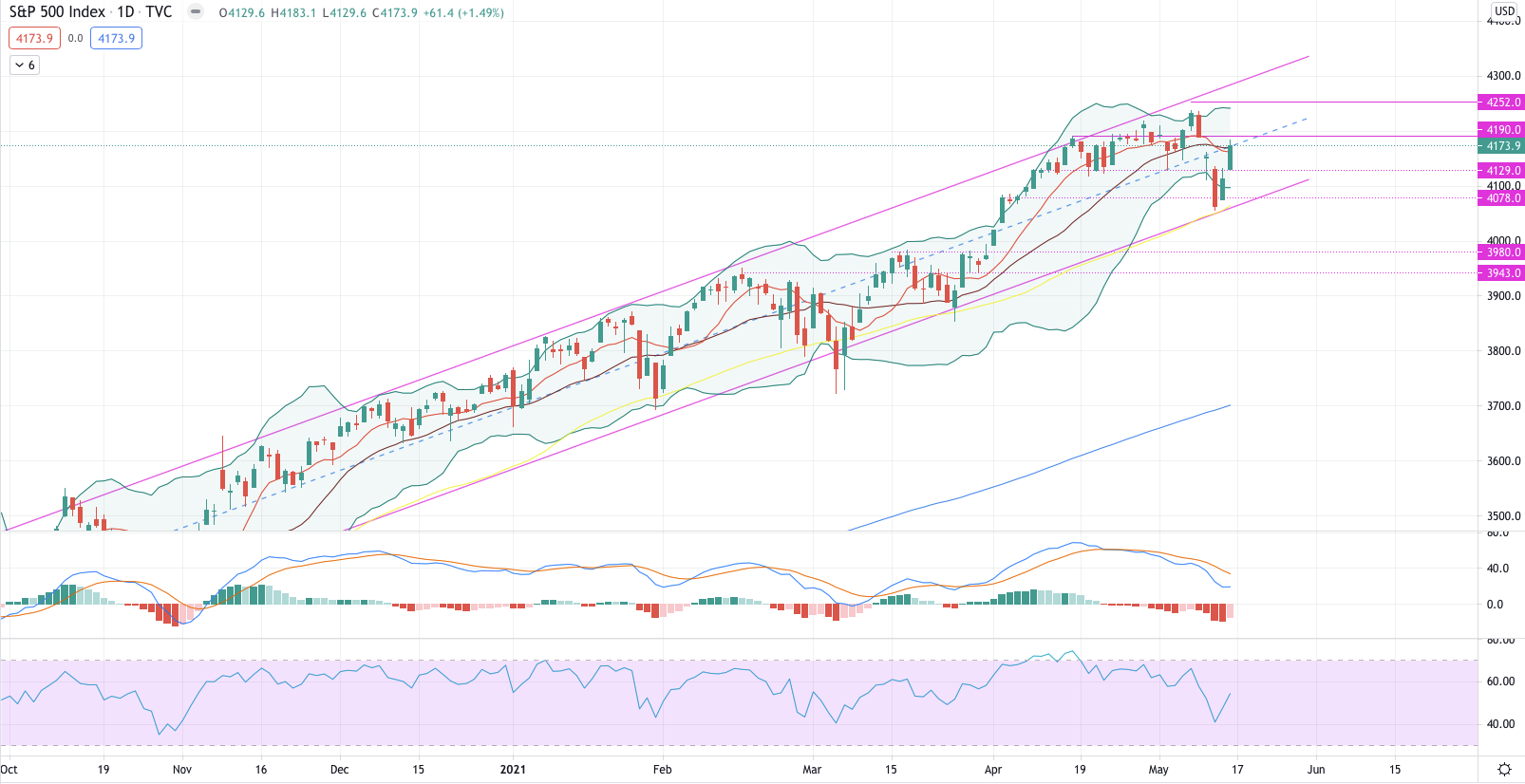

FTSE 100 (# UKX)

The negative week of the FTSE remained -1.45% lower, where it was able to unite with 50MA and jumped back to a strong resistance level.

Next week, if #UKX remains above 7,035 above support, we may see a continuation of at least 7,100. Alternatively, if it starts to fall below current support, we will target 6,950.

Tips

From a technical point of view, we confirm the acceleration perspective, where the latest 50MA has been tested again with the strength of an even more current trend.

The MACD crossed the line, but is now gaining momentum with an RSI pointing in the opposite direction.

If the index manages to remain above 9MA, we believe it may remain upside down to 7100.

Alternatively, we could see a stabilization phase between 7,000 and 6,950

In conclusion, we can discuss the design of the Beresh flag patterns: Therefore, the current level of support is crucial for understanding future directions.

Resistance at 7,035 and resistance at 7,145.

The DAX fluctuated sharply by + 0.03%, again touching the level of 14,801 before quickly jumping into the central resistance range.

If the index moves further up next week and closes above 15,500, we can see a continuation of the upward trend and a break in the current resistance.

On the other hand, sales below 15,300 could lead to further sales pressures and a revival of existing support.

Tips

From a technical point of view, this week's more than 50MA rejection confirms the bullish trend. In addition, it manages to run above 9 mA, which can provide the necessary current to break the current resistance.

MACD bends with an RSI pointing upwards.

Given the strong final movements, we can see a 9MA genetic test before we move on.

Support at 15,135 and resistance at 15,510.

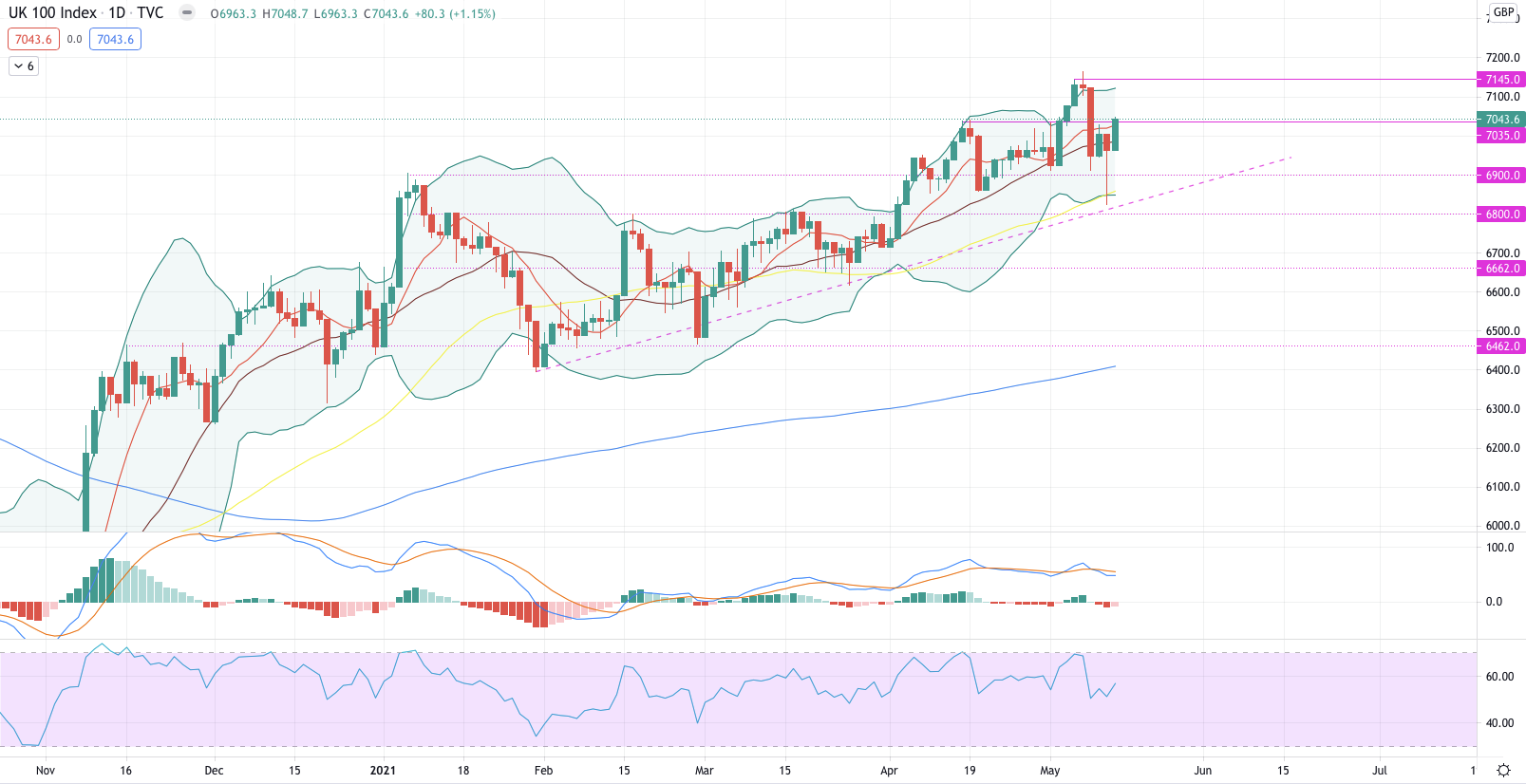

S&P 500 (#SPX)

The S&P 500 fell by -1.29% in a negative week, reaching a record high and finding strong support at 4,078.

If #SPX manages to stay above 4,170, we will target 4,220 for the coming week. On the contrary, a close below such a level would lead us to aim for 4,129.

|

The trend remains bullish, but it may now go into a consolidation state between 4.125 - 4.190.

Indicators

From a technical perspective, 9MA has been the real catalyst over the past few months: 9MA: a close above could lead to upward at least 4 240.

MACD turns around and shows a positive momentum, RSI also points upwards to the 40 point.

#SPX could very well enter a consolidation state that flows between 4,078 and 4,190.

Support at 4,129 and resistance at 4,190.

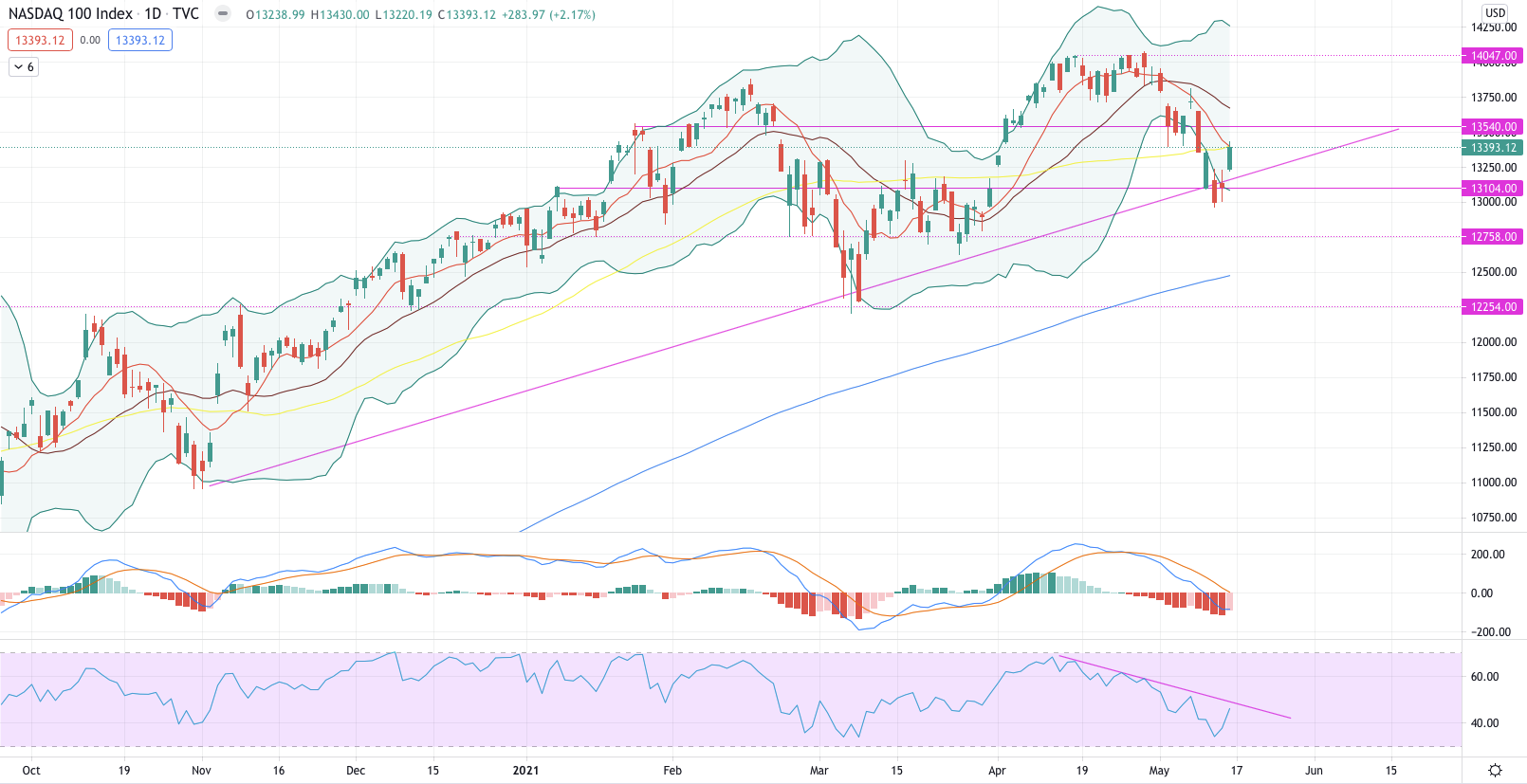

NASDAQ (#NDX)

Nasdaq fell a -1.41% negative week and found strong support at 13,104.

For the coming week, a close of more than 13,400 would confirm a continuation of upward to 13,800. On the contrary, if the index is rejected, we will again have strong support at 13,404 target.

Indicators

From a technical perspective, the selling pressure stopped at 13,104, making it a strong support area and a good turning point.

#NDX now maintains a confluence between 9MA and 50MA and at a level that served as resistance in February 2021.

The MACD indicates a reversal, although below 0, which is a bearish signal, pointing the RSI upwards. If we look at the RSI, it could not break the downward trend line: a break of it would confirm the upside potential.

As of today, we can see two scenarios taking place on the Nasdaq: either a rising triangle or a broader horizontal channel: the week ahead may help to better understand the future movements of the index.

Support at 13 104 and resistance at 13 540.

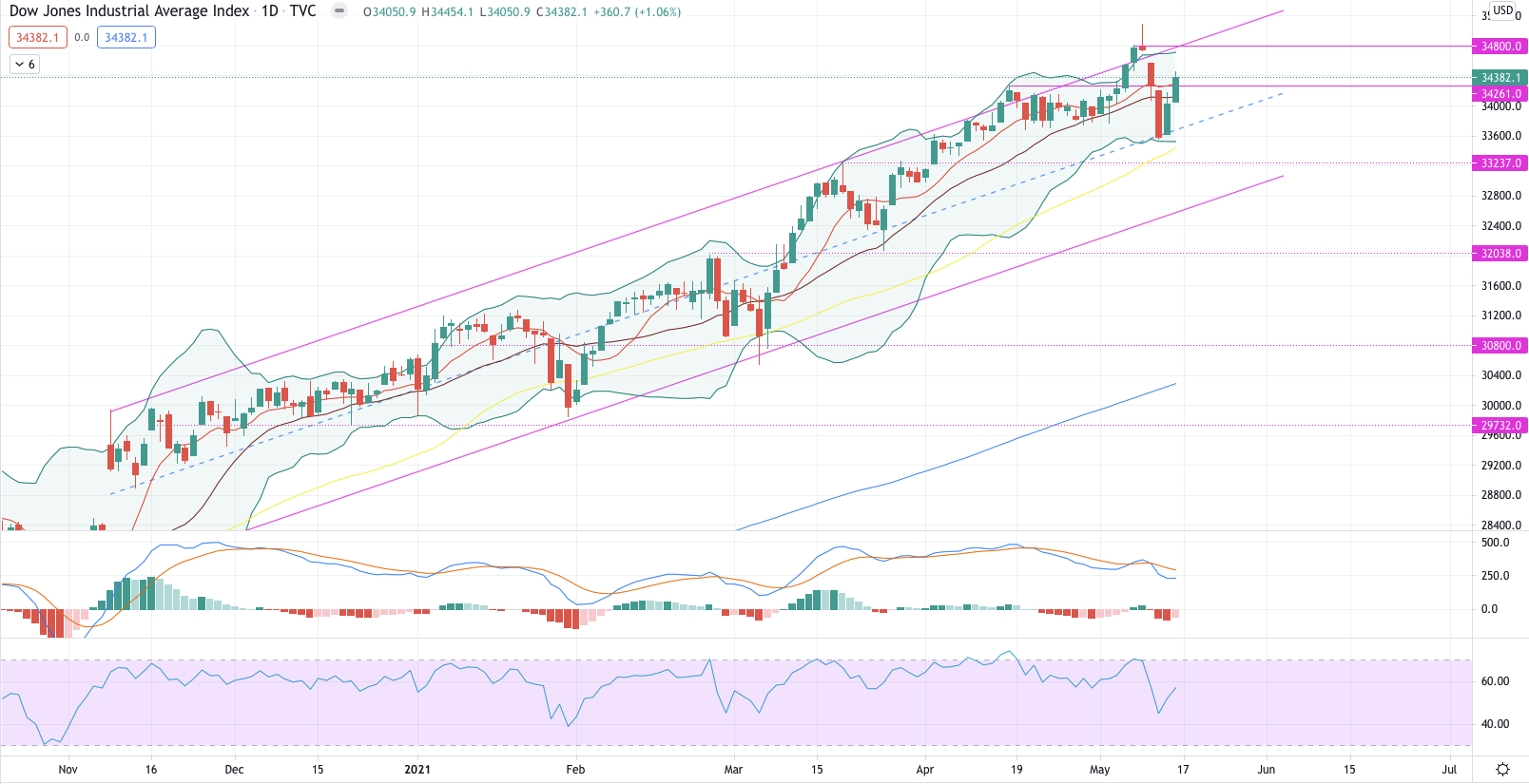

DOW JONES (#DJI)

The Dow Jones had a negative week below -1.59%, retreating from its all-time high and finding strong support at 33,600.

If #DJI manages to hold more than 34,261, we will target 34,500 for the coming week. On the other hand, a decrease under the current support of 34 261 will confirm further sales pressure, where we will target a conservative 33 900.

Indicators

From a technical perspective, the recent withdrawal offers a strong upward potential, but is now again at a very weak level.

The MACD is still positive and well above 0, confirming the bullish trend of the # DJI, along with the RSI testing the 45 level again and jumping back from it.

By allowing the formation of the last two trading lights, we are more likely for a short-term consolidation move between 33 750 and 34 500: This will enable the 50MA to remain strong as a support level to avoid deviation between RSI and price .

Support at 34,261 and resistance at 34,800.

0 Comments