S&P 500 correction looming just as in Gold

Shares are tied at 3,900 levels, and the cows are not cooperating. Without great worship, neither reading nor writing is called greed at the end of another field. How long will it take, and what correction will there be? Warning signs are on the rise right now, but bears really should not put all their eggs in a nesting basket, because it makes it too deep - because once more than price.

forex market open time

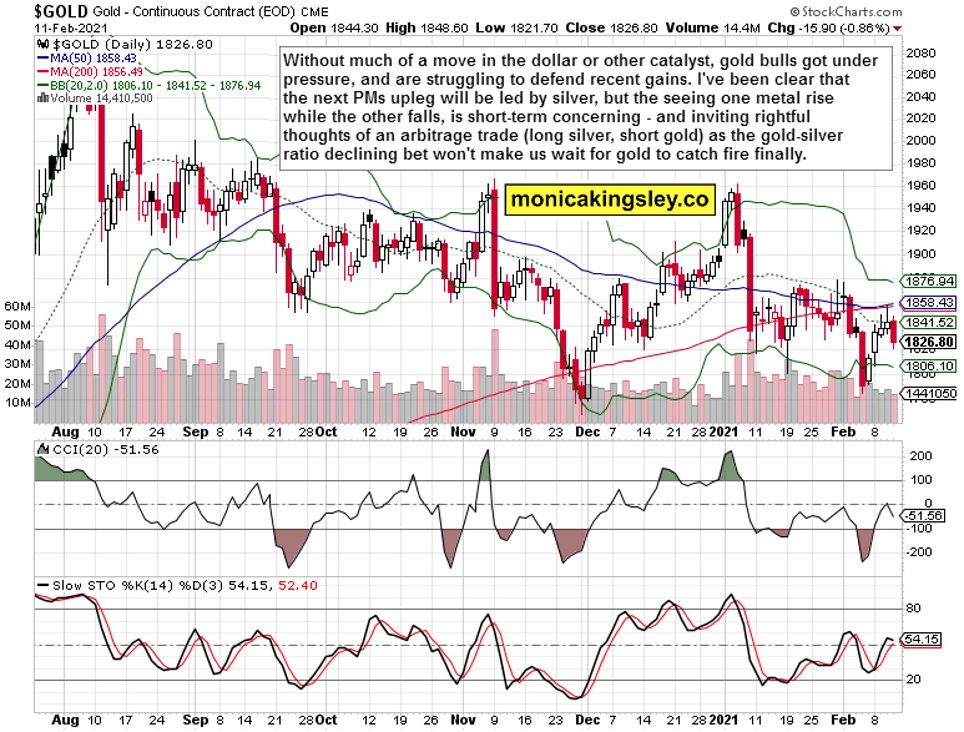

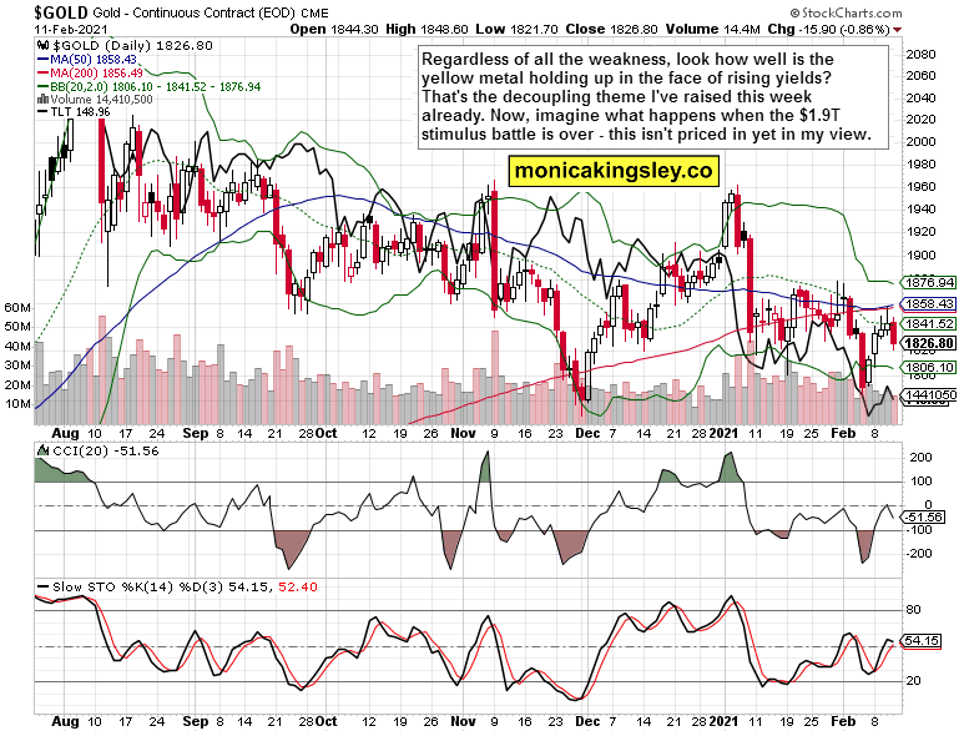

The strong gold core is another white tea and is clearly visible in both white and platinum formulations. At the same time, the dollar has not really increased - there is no stopping the dollar. If green is going to fall, that means the dollar market, which I don't see as a viable option - I called a dollar earlier this week. The world's money will continue to defend this year, we have not seen a vision, but it is the top of the city.

This has a strong effect on precious metals, the only question is whether we will get a weak repair on the surface or whether we can build a narrow and other UV base (waiting for water) Dear February is not the hardest month of February, it is true. But it is not an accident. As it is every week, today I am updating and showing evidence of environmental strength.

An article about marketing - in print and fun printing in the world, where giving or taking an exciting $ 1.9T will come sooner or later, we are well prepared and we will address the risk of precious metals, and it is good that you do not. I kept repeating myself that it was foolish to come first, and that was not enough, but in my opinion. All of those reform partnerships must be protected - whether by technology or elsewhere, because we generally rise up - whether we like it or not.

Let‘s get right into the charts (all courtesy of https://forexmarketnewsdily.blogspot.com/).

S&P 500 Outlook and Its Internals

On the third day of the season, he threw it to the ground again. The volume is increasing, and it speaks of firm faith on all sides. In short, my words are still there today.

forex market open time

(2) I think this transition period has been a bit successful over time. (2) Bears shake the boat, that's all.

Market capitalization is deteriorating, in fact no financial value follows. So far, corrections have been made over time, often side by side. Unless you have seen this picture

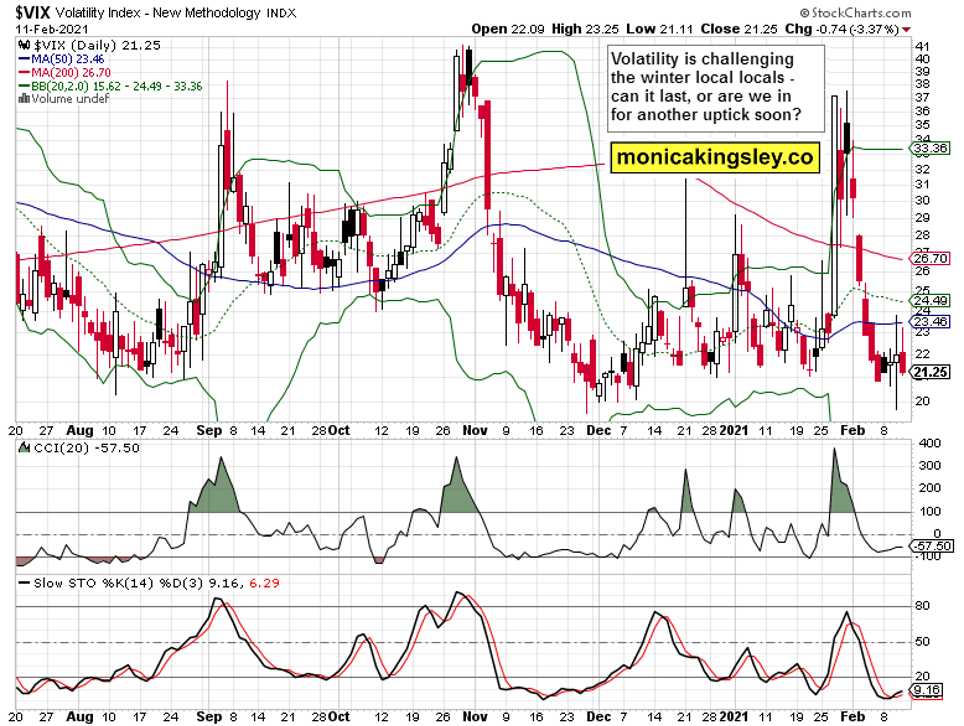

Flexibility is dead recently, but short-term exposure (not reaching high, hitting 24 levels) may not remind us of our visit from last Wednesday. It is more likely to catch up with lower product prices. Nice to see.

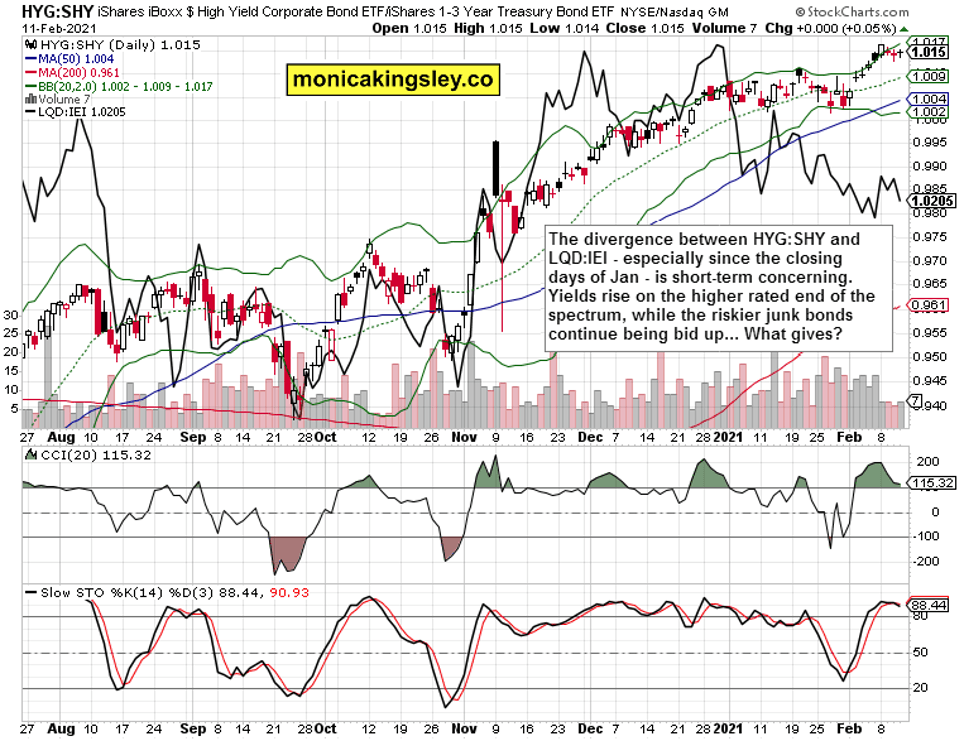

Credit Markets and Tech

There is a growing rift between the company's HYG ETF and its investment partners (LQD ETF). The two-lane direction to the stock market has not changed since the end of January, but it is about 2021. Increasing production volume puts pressure on the high end of debt as the size of the business continues - that’s mine

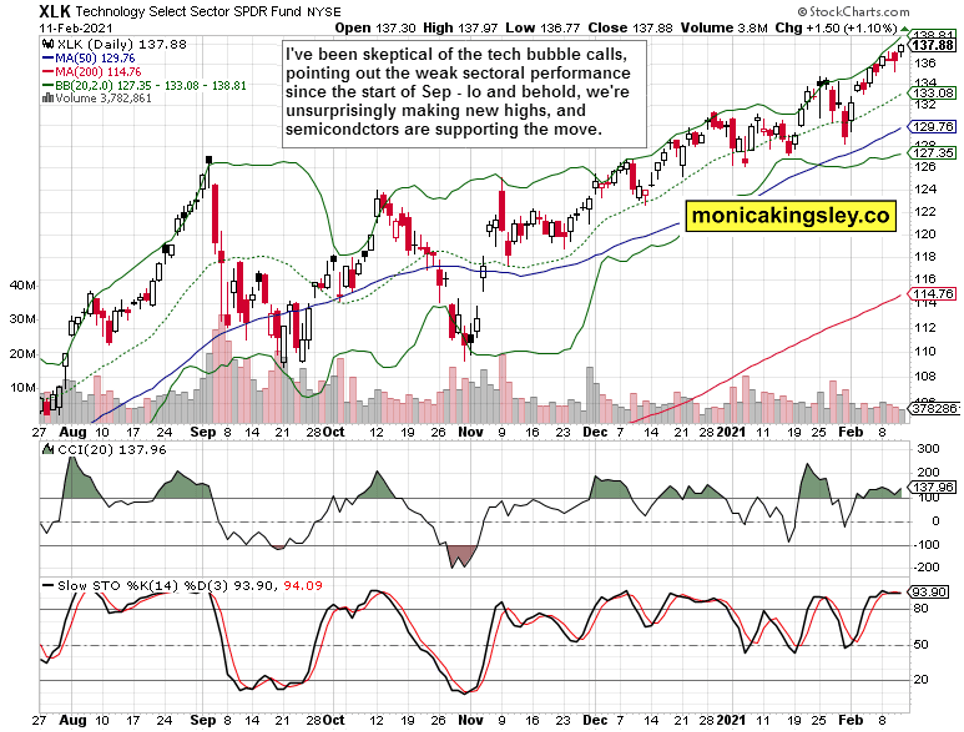

No, this is not a bubble - it is not symbolic. They say the technology sector is slowly taking the lead in the S&P 500 as well as micro-heaters as profitable and unprofitable. High prices are coming in, revenue is rising, and prices are not in dispute

At right-click pressure ($ 1,815), the gold technology did not slow down. By the end of last Thursday, the daily indicators will be ready to ignite a riot once the price stabilizes. But for all the serious English words. We were not spoiled by the end of November.

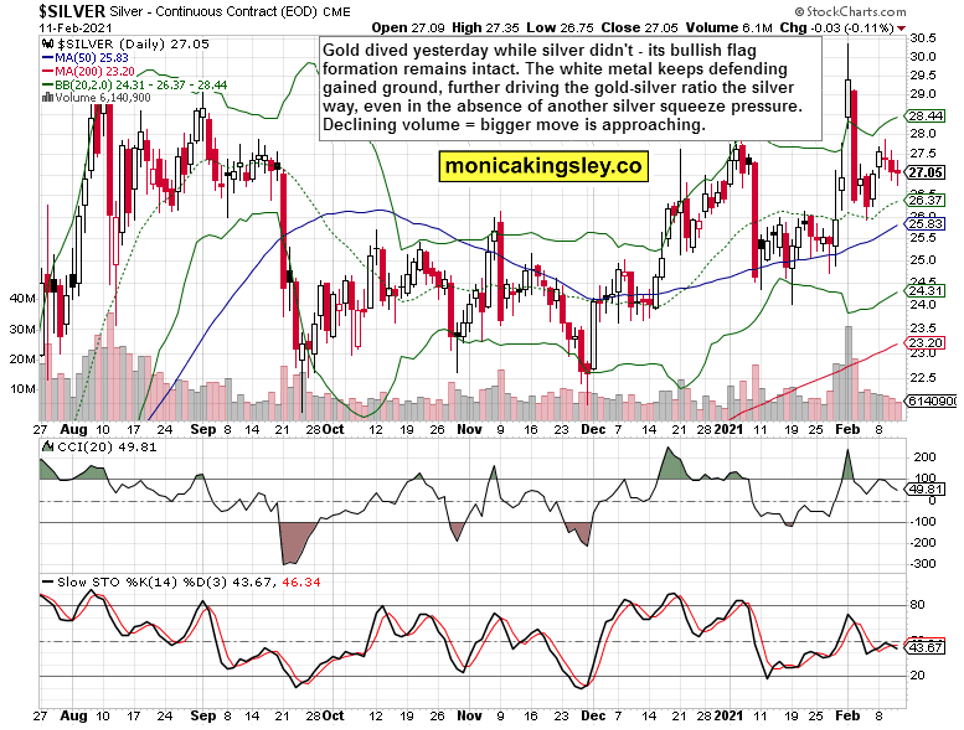

I create business opportunities for those who want that. Before the gold and silver ratio was lowered, long silver, little gold was exchanged for me. Similarly, betting is a long-term business, but it can take a lot of patience and perseverance.

A beautiful table shows that gold does not follow the pace of modern production. The depletion of this resource is a good sign for the region, as well as what is expected of each seed.

With the support of the silver, it continued to trade, and in contrast to gold, short-lived bull flags remained. The maximum stability for silver is still high.

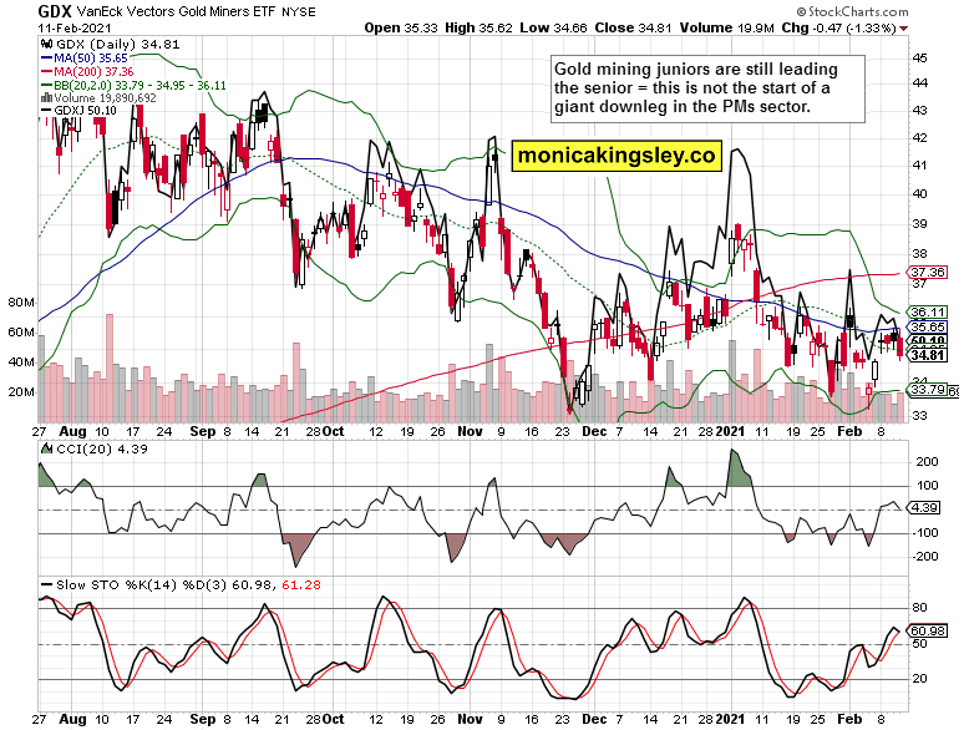

Gold miners retain their power from mature gold miners, the mining industry continues to send out signals, and silver miners are stepping in. the picture is unique.

forex market open time

In summary

The trade-off is endless, but signs of damage are coming. However, the bulls are not at risk, and so far there are no signs of severe correction.

Unlike bulls, golden calves have a hard time defending their interests. This is a short-term reality, despite the legal and monetary policy, the recovery of the real economy, the recovery of inflation and the destruction of the US dollar. The new Upleg will knock on the door, and Trudy will be heavily rewarded.

0 Comments