- Bitcoin price dropped 6% and continues to decline after Elon Musk’s recent tweet.

- Google decides to run crypto-related ads after early 2018 ban.

- China pulls a 180 as state-run media outlets reveal that the public is free to trade cryptocurrencies.

The Bitcoin price is currently high, probably by retail buyers, as Tesla CEO Elon Musk posted another market-disrupting tweet. Although vague, retail has already started selling its interests. Although it is clumsy in the short-term scenario, several on-chain wear it.

Bitcoin Price Holders

The acquisition of Tesla CEO Elon Musk at Bitcoin was an interesting development to follow. His tweets on May 12 and 19 played an important role in the placement of the BTC prize crash.

The biggest companies today released a secret tweet that sparked rumors that Tesla would sell its Bitcoin holdings.

If true, lowering the price of Bitcoin may be the preferred bet. especially when considering China’s pressure on the BTC mining sector.

However, state government Xinhua News and China Central TV reported this week that "the public is free to trade with its freedom." Hmoo "China 's involvement in the cryptocurrency industry does not seem to be determined yet after Google lifted its ban in March 2018 and protected people from notifications of cryptocurrency intrusions.

Google's announcement on Wednesday states:

From August 3, advertisers will be able to launch Cryptocurrency Exchange wallets and wallets, these products and services that provide them with the following requirements and certified by Google.

Google's relocation is an important step that will help companies grow in the cryptocurrency ecosystem and thus increase its sustainability.

The small Bitcoin approval, which took place in early May, appears to have slowed in the first week of June. The US Securities and Exchange Commission (SEC) has announced that it will postpone its decision on WisdomTrees application for Bitcoin ETF names from May 30 to July 14.

Intensified determination

The value of Bitcoin is in a difficult and visually appealing situation. BTC illustrates head and shoulder models and is seen as another 53% high if it crosses the neck at $ 29,936. However, this bearish situation has not yet been resolved in the stone and would become inaccurate if BTC continues to rise.

But estimates have to do with this. $ 42,000, resulting in a split in the horizontal line of $ 29,936, would lead to a negative loss of concentration in the Bitcoin price.

In addition, crypto ships also developed a clumsy feather pattern.

This billing process has a very large eye, called the flag symbol and

is usually followed by a common procedure called a billing system.

This configuration estimates a 50% drop and due to the lower pendulum line split at $ 35,965.

While the recent price of Bitcoin seems to ignore this pattern, Musk’s tweet sent him to the back door. If BTC continues to shrink and manages to build daily candles close to $ 35,965, it signals a start and an end.

BTC/USD 1-day chart

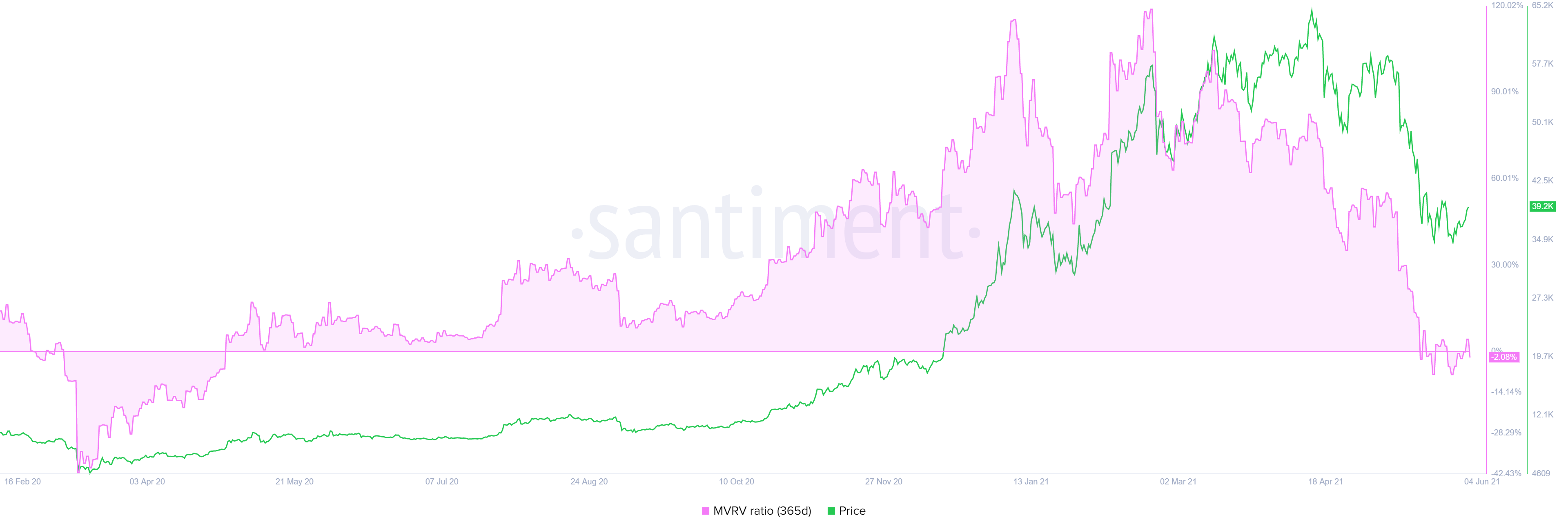

With these bearish models close at hand, the market is probably not optimistic about the groundbreaking cryptocurrency. Supporting a decline in Bitcoin's price is the 365-day market value to realized value (MVRV) model, which is about 0%.

This index assesses the health of the BTC network by tracking the average profit/loss for investors who bought BTC last year. Although it resumed close to 110% on Feb. 11, this reading suggests room for downward movement.

BTC 365-day MVRV chart

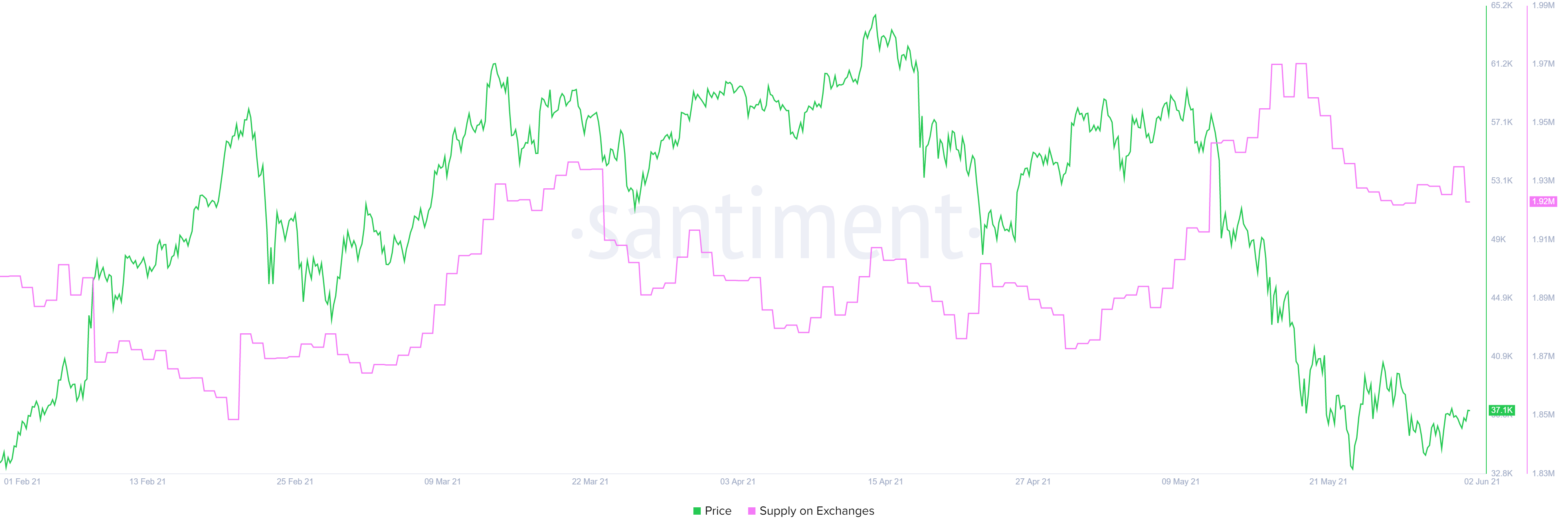

The supply stats on exchanges are simple and an increase in this index can be interpreted as a possible increase in selling pressure.

From March 1 so far, the number of BTCs on exchanges dropped from 1.97 million to 1.93 million, suggesting that some inventors were quick to be optimistic about Bitcoin's performance.

However, as of March 1, BTC for centralized units is up about 3.2% from 1.87 million to 1.93 million, an increase in the medium and long term.

BTC supply on exchanges chart

Although the current state of the Bitcoin price so far needs no inspiration, and a larger daily search of more than $ 46,000 will mark the start of a growth and worthless clumsy pendulum model.

But if BTC spends more than $ 50,000, it will end up shaping its head and shoulders. The move will also lead to FOMO retailing raising it to its highest level of $ 59,600 on May 10th.

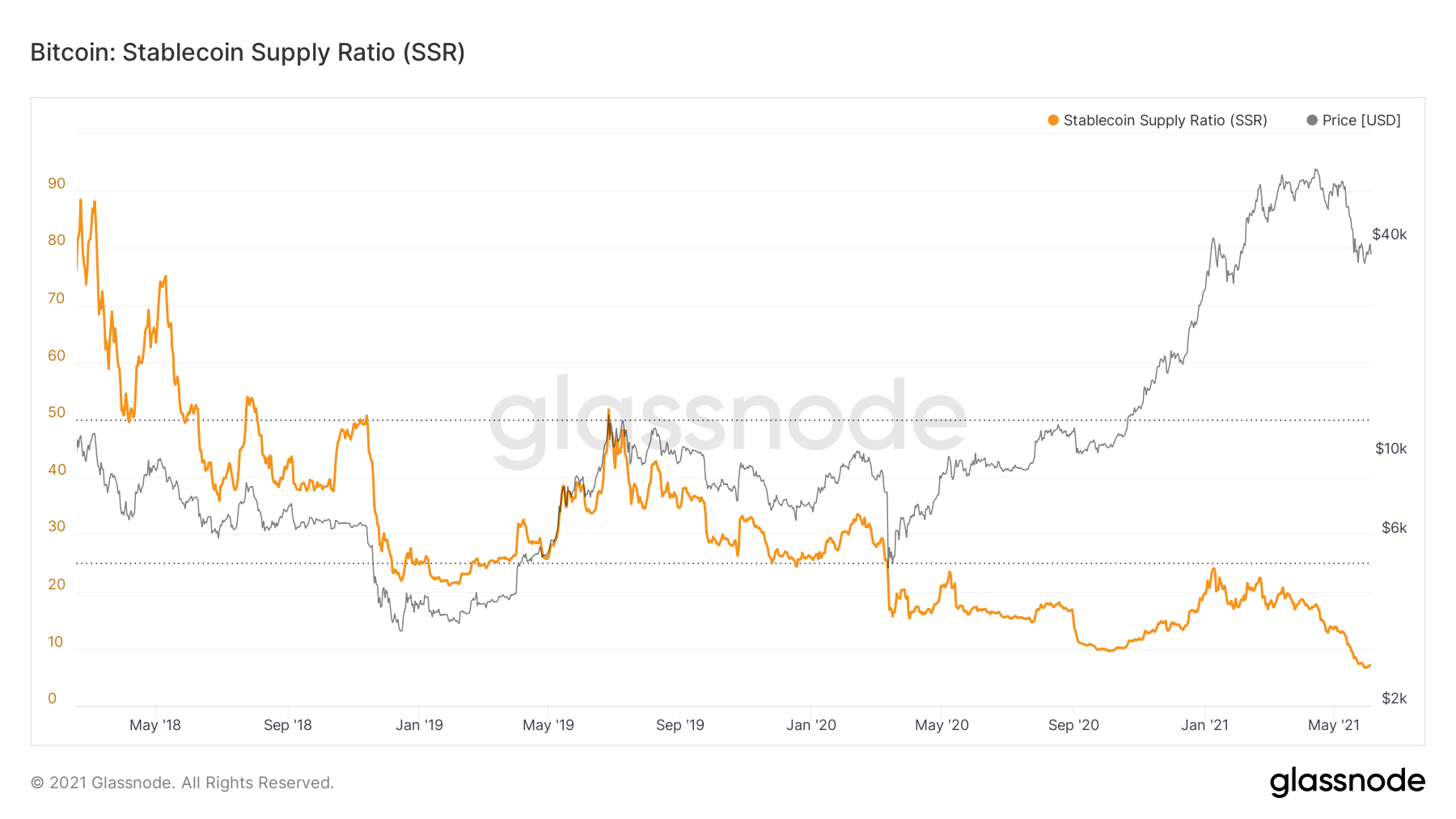

This scenario is supported by the Stablecoin Supply Report (SSR). This measurement is the ratio between BTC held in centralized units and the stable share of the currency on the stock exchange. A decrease in this index indicates higher purchasing power.

The SSR has so far dropped from 13.84 on May 1 to 7.14 by 48%.

BTC SSR chart

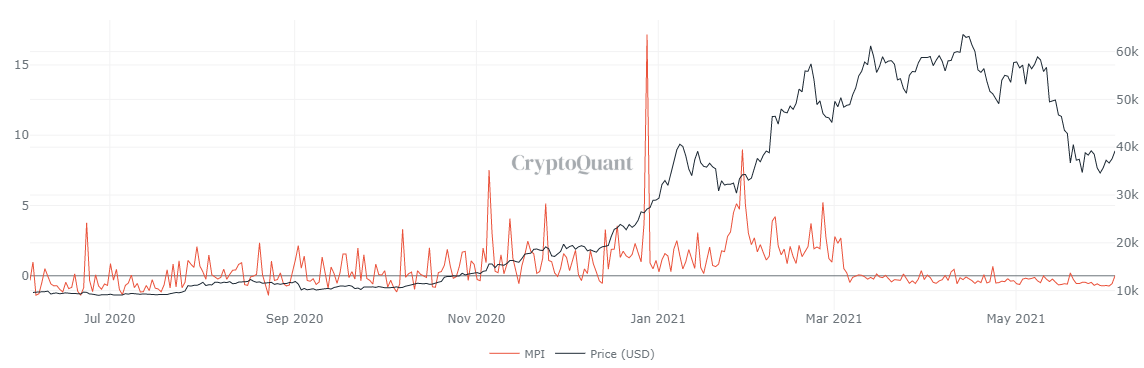

Despite the proliferation of Bitcoin mines, miners appear to be strong, and this can be seen in the Miners Position Index (MPI). According to CryptoQuant, MPI is the BTC report that leaves the wallets of all miners up to the 1-year moving average.

This indicator has been below zero since the beginning of March, indicating that at no stage do the miners intend to sell their gold shares.

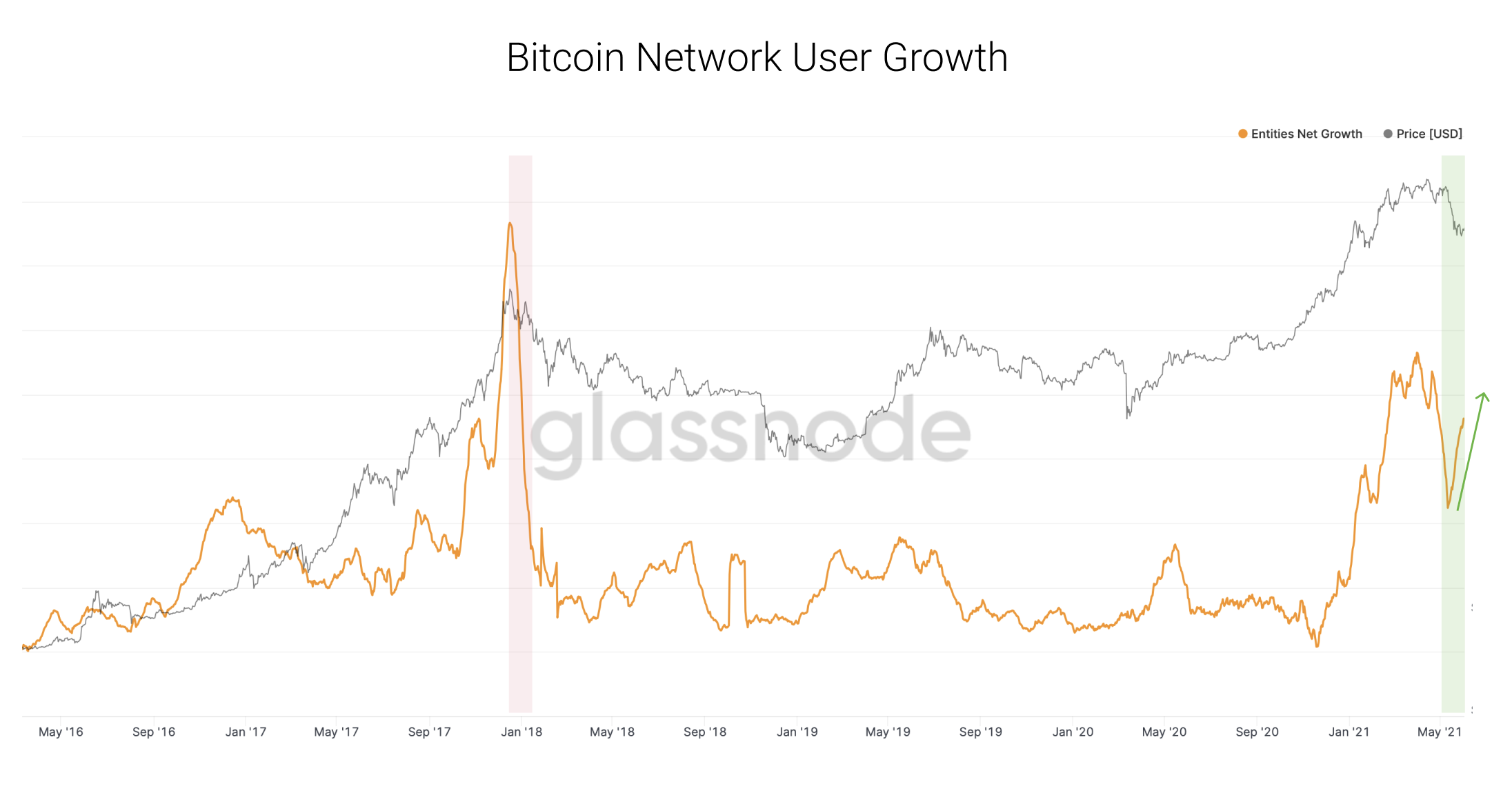

Statistics on the growth of Bitcoin network users also show a positive bias, because there is a need for new users to join the network despite a sharp decline.

Normally, a drop in this indicator would indicate the start of a bear market. According to Willy Woo:

We see that new users are taking the opportunity to buy Bitcoin for the first time during this price drop. This is a typical sign that we have NOT entered a bear market.

After the week has been spent taking advantage of weaknesses, the price of Bitcoin has shifted to a draw. The current resistance level is $ 42,000 and the hurdle is $ 33,200 or $ 30,000 for $ 30,000 and you will not be able to repay it for Bitcoin.

Therefore, the investor should be careful as BTC consolidates and has not taken a clear bias.

0 Comments